[ad_1]

jiefeng jiang/iStock via Getty Illustrations or photos

Released on the Value Lab 29/6/22

GSI Technological innovation (NASDAQ:GSIT) is just one of lots of shares that continue to depends on funds marketplaces and has endured as share reflexivity has taken its toll on the essential prospective customers for equity holders. The business is a extensive way from starting to be cash favourable once again with its new APU endeavour dominating the expense construction, and far more money burn off is to come as that mission matures, but given that last time we have gotten extra clarity on timelines. They are shut to releasing a new system for developers to much better interact with the Gemini-I and exam their algorithms, and they are also coming up with the Gemini-II which will be the generation model. We get a lot more clarity on business development, and how the corporation is only just beginning the changeover to considering about marketing the Gemini for clients. Lastly, the legacy organizations is growing superior than predicted, and new contracts incoming enable it to make more powerful income flows to mitigate capital market place requires for the Gemini enhancement. General, GSIT stays speculative, but the inventory is exciting and bettering its capacity to self-sustain their advancement opportunity and limit money marketplaces and reflexivity dangers. We keep on to be very long.

FY Updates: Commercialisation Considerably Off

In our prior posts on GSIT, we had been creating our being familiar with of what the chip may well be valuable for, contemplating about its many programs in search and recommendation but also past in the world of neural networks which are getting to be extra and extra computationally intensive, concluding that its marketplaces could be broader than just look for and suggestion based mostly on how neural networks are being structured these days in accordance to some most effective procedures. Nonetheless, the concentration of these article content has been on the markets, and it really is been a when since the enterprise has specified concrete facts on its have business development. With vital release dates just about to occur up, it really is time to touch foundation and update the firm’s fiscal photo as perfectly, which is strengthening thanks to the legacy business bettering its overall performance and building additional margin versus needing to go to capital markets. This is essential, because the GSIT inventory has fallen 15% since previous coverage and 30% YTD, and relies on fairness and not credit card debt funding in addition to operational income flows.

The FY business updates emphasis on a several crucial factors, and give us a a great deal clearer timeline than we had ahead of. Very first of all, the delays in the full release of the compiler stack have ongoing, pushed back about 6 months, with the current date as of May perhaps remaining a July release. In accordance to management, the further time taken was to make it out there in Python (not at first component of the plan) which is a language that is a great deal a lot more greatly applied and consists of non-laptop or computer experts like info scientists and entities like college faculties that have fewer assets. At the moment, dozens of integrators and other entities are working with the chip for their experiments, mainly through the cloud hosted by Israeli and US-centered knowledge facilities, and the launch of this compiler stack need to make the chip usable to a considerably broader selection of entities.

In addition, the chip proceeds to conduct at the top in checks and competitions in buy to earn attention from organisations like the Office of Defense. The apps are in laptop or computer vision, unsurprising specified the positive aspects of the APU, and in other applications that are matrix intensive. These assessments function with datasets offered by highly regarded organisations like the MAFAT problem from Israeli Protection Ministry and other major conferences. GSI is profitable and main competitions not only in its core markets of advice and research, but also a lot more frequently with AI apps dependent on neural networks for essential and eye-catching marketplaces like defense and security.

The firm’s APU endeavour is just a software advancement staff at this place, and is only just now commencing to put collectively a marketing drive that can test court docket entities like the DoD as very well as future-gen warfare companies and of course businesses. This is currently being completed in tandem with progress of the subsequent style and design for the Gemini APU, the Gemini-II, which will incur charges for style to the conclusion of the calendar calendar year. This next layout will attempt to strengthen the price general performance of the APU and get it a lot more prepared for creation. But to be crystal clear, there is no infrastructure in put still for manufacturing, and acquiring foundries included has not even began nonetheless. With the layouts for the output chip not even out, and most of the engagement with the Gemini-I going on through the cloud (mainly because there usually are not numerous Gemini-I types in existence), the commercialisation of the Gemini is even now extremely considerably off.

Money Burn & Financials

The firm is anticipating the money melt away to be comparable in 2023 fiscal calendar year as it was in 2022 at about $14 million. Funds fell by about $10 million YoY with internet losses for the entire yr with the web adjust in stockholders fairness indicating about $4 million in equity raisings (5% of marketplace cap) which is not pretty much, and administration expects that exact charge of money burn up (of about $14-15 million) also such as the just one time price similar to the structure of the Gemini-II which should be about $2.5 million. Cash balances cover once-a-year income burn for about 2-3 several years assuming no more equity raising.

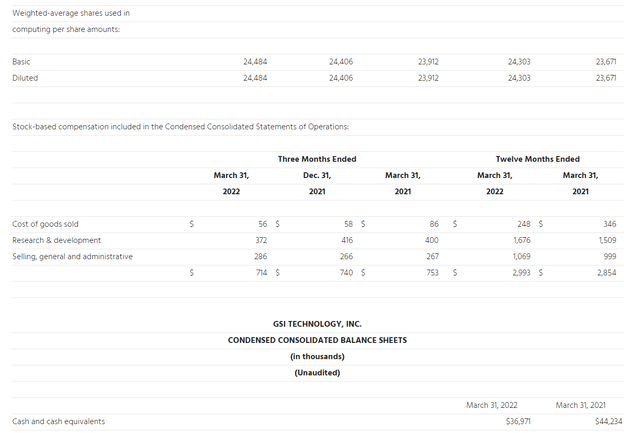

IS and BS Information (Q4 2022 PR)

The fiscal picture continues to be dependable with the company’s communicated story. The revenues are growing a bit with some advancement in the income SRAM business, and gross financial gain is increasing with much better business combine with army and defense having a lot more share. This is offsetting a significant and expanding R&D expenditure. R&D is about $24 million yearly, with the following decline getting all over $18 million, and can be basically totally attributed to the Gemini APU attempts with the get the job done on the stack compiler and also the Gemini-II style. With out the R&D expense the enterprise would be at a profit and a pre-tax internet margin all around 15%. Enhancements in the legacy business are providing GSIT a runway, and the dilution that is happening, about 5% of sector cap, is remaining offset by the accumulation of net functioning losses (NOLs) that constitute a income tax asset for down the line. Presently they are all over $14 million in worth and can offset future tax liabilities.

Outside of 2023

On the other hand, the price of funds burn, currently mitigated by the current run-price from the legacy business, could occur down assuming the same level of R&D expenditure because of to new essential contracts. The firm is working towards a deal that will start off with a prototype shipment in the Q1 2023 (existing quarter), and the magnitude of the orders related with this contract could rival the recent whole revenues and thus increment sales meaningfully more. These contracts would be realised later on on however, likely making income a calendar year from now if the prototypes are a achievement, and could continue to assist the strengthening profits photograph over and above 2023 which has already noticed YoY advancement of 20% as of the latest FY 2022 report. Also, down the line, there is also talk of synergy amongst their legacy business, which includes Rad-Difficult, of which prototypes are being transported to satellite contractors, and the Gemini APUs. The businesses for that reason are not with out cross-marketing alternatives, and the legacy SRAM business is in fact performing like much more of a advancement area these times with further more profits to military and defense. We assumed it would be a plodder in terminal drop but it is not, which modifications the GSIT profile very a large amount as it shores up the running income stream streams for funding Gemini.

Conclusions

The organization proceeds to build its chip which is intended to have bypassed critical chip constraints, earning it fantastic in efficiency for sure programs which we have elaborated at length on SA. The specialization and value from this freshly invented architecture is proving itself in troubles posted by dependable organisations, providing GSIT visibility to the likes of the DoD and Israeli defense. Nonetheless, when the know-how seems to be significant, it is very clear that they are quite significantly from creation of the APU, possible years away, wherever beforehand we worried about the recent semiconductor shortages becoming a challenge for their commercialisation. All those will most likely solve prolonged ahead of GSIT is in commercialisation phases of its Gemini. Although this is a damaging due to the fact it indicates the tale lacks a catalyst, in the meantime, they accumulate NOLs that assistance deal with the simple fact that equityholders from time to time do get diluted thanks to higher R&D, by about 5% per year it appears presented dollars burn projections, but probably significantly less outside of 2023.

With improving revenues in the legacy business, the capability to lower the funds burn off sustaining existing R&D increases, and Rad-Really hard and legacy products and solutions are performing incredibly well by now with new vital contracts incoming. Nonetheless, they still have to have to set a income drive to do the job, and there is additional SG&A to be incurred which currently however lies at small concentrations. It will be decades ahead of this inventory pays off, and as these kinds of, it is until eventually even further observe useless capital. The challenge is the moment a little something improvements, the worth could choose up drastically, so we are not leaving the posture.

Far from Gemini production, and continue to only starting to engage with entities who are fascinated in the Gemini and its employs with the compiler stack only becoming completely introduced subsequent month, the APU story is nonetheless in early phases of proving strategy, and the industrial chance is further off than we anticipated. Nevertheless, we update our check out with that the legacy business should produce more to the GSIT coffers and to the Gemini work, albeit a person that will be more time and additional arduous than we might hoped, restricting the unfavorable results of reflexivity. Total, an interesting stock, but the early-phase nature of it, mitigated fiscally by an ever more financially rewarding legacy business, indicates it’s at ideal a speculative publicity, but a single with confined downsides in comparison to straight VC-fashion exposures or SPACs. Even now a get, but for the instead prolonged-term.

[ad_2]

Source backlink

More Stories

The Power of Investment for Financial Freedom

The Importance of Investing Early in Life

Building Wealth Through Smart Investment Choices